404

Tego Insure was purchased by Strong Insurance! Click below to enter the new trucking portal!

404

Tego Insure was purchased by Strong Insurance! Click below to enter the new trucking portal!

Table Of Contents

Operating Radius ↴

Driving History/Record ↴

Insurance Company ↴

Time In Business ↴

# Of Employees ↴

CDL Experience ↴

Type Of Cargo ↴

Value Of Truck(s) ↴

Vehicle Size & Weight ↴

CSA Score ↴

Credit ↴

Raise Your Deductible ↴

Pay In Full For The Year ↴

Bundling ↴

Remove Unneeded Coverages ↴

Learning The Basics Of Truck Insurance Risk Calculation

As a truck driver, it is important to be aware of the factors that will influence the price of your premium. By being informed, you can make better decisions when it comes to finding the right insurance policy for your business and saving on truck insurance premium. Keep in mind that every insurance company is different and will have different pricing structures. Be sure to shop around or choose an Insurance agency like

Tego Insurance which can compare rates with multiple carriers before making a final decision.

1. Operating Radius

The operating radius of a truck has a direct impact on the price of the truck's insurance premium. Trucks that have a wider operating radius will generally have a higher insurance premium than those with a narrower operating radius. This is because trucks that travel longer distances are seen as being more at risk of getting in an accident.

Additionally, trucks that cross over state lines will have a change in premium price. When a truck is insured in one state it may actually be insured under a different set of rules once it enters another state automatically. This can impact the insurance risk which directly results in a change of premium price for the policy period.

2. Driving History/Record

Truck drivers with a clean driving history will generally have a lower truck insurance premium than those with a history of accidents, tickets, and claims. This is because insurance companies see drivers with a clean driving history as being less risky and therefore less likely to file a claim. If you have any blemishes on your driving record, be sure to disclose them to your insurance company before obtaining a policy. If you don't inform the insurance agency/company about the issues on the driving record and it somehow slips through and is brought up later during the policy period, the policy will be immediately canceled and could impact the future price of your insurance.

3. Insurance Company

Choosing the right insurance company is one of the main factors in determining your premium cost. Not all insurance companies are made the same, some specialize in specific types of risks and businesses which allow them to understand the market better and deploy better rates. It's all about finding the right insurance company while also taking into account the other various factors that influence premium price.

It's also important to understand the difference between an Insurance Agency and a "Insurance Company" is how we're structured. An agency can quote through multiple carriers while a company can only quote through their company and cannot provide quotes from other carriers. That's why finding an established trucking insurance agency is so important to saving on premium.

4. Time In Business

The longer a company has been in business, the lower its insurance premiums will be, the sweet spot for most truckers is roughly 2-3 years. This is because insurance companies see longer-running businesses as being more financially stable and therefore less risky. If you are a new trucking company (1-2 years), be prepared to pay higher premiums than those with a longer history.

5. # Of Employees

The number of employees you have working for your trucking company is directly related to the price of truck insurance premiums. Truckers with more employees on staff will generally have a higher insurance premium than those with fewer employees. This does not mean you will be paying a higher premium per truck, in fact, you may pay a lower premium per truck depending on the size of the fleet and other variables listed in this article.

6. CDL Experience

While insurance companies don't expect you to drive like this...

It feels like their rates expect you to.

Truck drivers with more CDL experience are generally seen as being less risky and therefore will have a lower truck insurance premium. This is because insurance companies see drivers with more experience as being better equipped to handle unexpected situations on the road. If you are a new truck driver, be prepared to pay higher premiums than those with more experience.

7. Type Of Cargo Your Hauling

The type of cargo a trucker is hauling can have a significant impact on the truck insurance premium price. Certain types of cargo are more likely to be damaged or stolen. For example, cargo that is expensive or difficult to replace, such as electronics or pharmaceuticals, will likely have a higher insurance premium cost than cargo that is less valuable, such as food or clothing. This has proven to be a higher risk for insurance companies which is why the premium price is impacted.

8. Value Of Truck(s)

Different types of vehicles will yield different risks for the insurance company. Older vehicles are more prone to breakdowns and issues while a newer truck can lead to lesser risk because of fewer miles, updated equipment, and more, thus leading to a decrease in a premium price.

9. Vehicle Size & Weight

The size and weight of a vehicle has an important role to play when it comes to determining the truck's insurance premium. Generally, trucks that are larger and heavier will have a higher insurance premium than those trucks which are smaller and lighter. This is because bigger vehicles tend to cause more damage should they get into an accident with another vehicle or object.

10. CSA Score

CSA stands for compliance, safety, and accountability. This program is enforced by the FMCSA that holds truckers and owner-operators accountable for safety. Having a good score will help decrease your insurance premium because carriers will like to see that you are involved in safety on and off the road with your trucks and drivers.

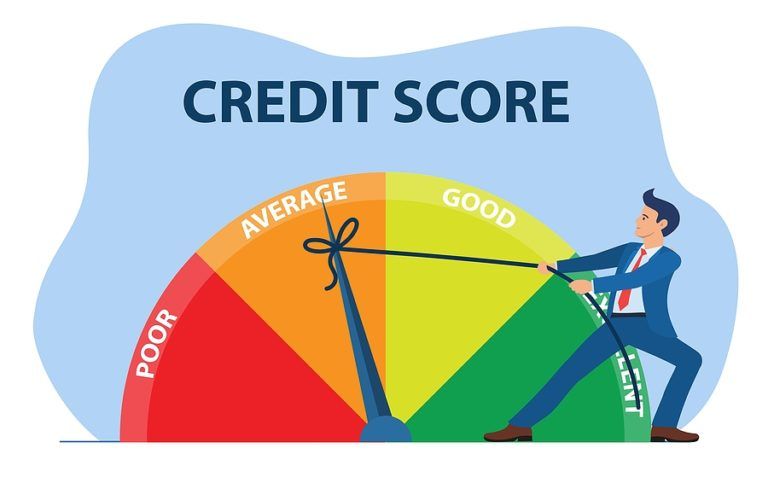

11. Credit

Your credit score is another important factor that insurance companies look at when calculating your truck insurance premium.

A high credit score indicates that you are a low-risk customer and will likely fulfill your financial obligations for the policy period. A low credit score, on the other hand, indicates that you are a high-risk customer and may lead to higher premiums. All A-rated insurance carriers will perform a credit check during the quoting process.

12. Raise Your Deductible

Raising your deductible will have a direct impact on the price of your truck insurance premium. By increasing your deductible, you are agreeing to pay more out-of-pocket in the event of an accident. This will cause the insurance company to see you as a less risky customer and lead to a lower premium price.

On the other end, if you choose to lower your deductible, you will be seen as a higher risk and will likely pay more for your truck's insurance coverage.

13. Pay In Full For The Year

When you pay for your truck insurance premium in full, you are essentially giving the insurance company a lump sum payment. This is beneficial to the company because it allows them to invest the money over a longer period of time.

When you pay in installments, the company has to use that money to cover claims as they come in.

This can lead to financial instability and less money to invest in new technologies and safety features.

When you pay in full for the first year you can save up to 15% and will not be obligated to pay monthly.

For example, if you operate 1 unit and have a $13,000 per year insurance premium, a 10% discount would decrease the cost and save you $1,300 on the truck's insurance premium and a 15% discount would save you $1,950!

14. Bundling

Bundling your truck insurance with other types of insurance, such as your personal car insurance can have a impact on the price of your premium. This is because the insurance company sees you as a reliable customer and is willing to offer you a discounted rate.

15. Look For Unneeded Coverages

One way to save money on your truck insurance premium is to get rid of any overlapping or unnecessary coverages.

For example, if you have collision coverage on your truck, you may not need comprehensive coverage. This is because collision coverage will pay for damages to your truck in the event of an accident. Comprehensive coverage, on the other hand, will pay for damages to your truck that are not related to an accident, such as theft or vandalism.

The same goes for underinsured motorist coverage. If you have liability coverage, which covers damages related to accidents, then this type of insurance may not be required to operate.

This advice is not recommended to implement until you talk with a licensed insurance agent about your specific company goals and requirements. Some companies need all the coverage they currently have and some companies are severely uninsured and should consider additional coverages. Talk with an agent by getting in touch with Tego Insurance online.

To ensure the highest degree of accuracy, all posts go through a strict editorial process and are reviewed by a licensed insurance agent.